Paytm full form as Pay through Mobile is a revolution towards online payment. To earn money, In most cases Paytm act as a middleman and collaborate with various companies of specific fields and charge commission from them.

Paytm have the platform and the consumer base which allows Paytm to charge commission from companies who want to advertise their product on Paytm. (This is known as Cloud servicing)

However, Paytm earns 75% of its revenue from Paytm Wallet, Paytm Bank Account, credit, UPI, Bill payment, and bookings. Rest 25% of its revenue is earned through commercial and cloud activities. The estimated revenue of Paytm is 2800 Crore per annum.

Table of Contents

10 Ways How Paytm Earns Money

When every company started the service of digital payment to expand their business. A digital payment service company started to do everything on its platform. So there are the 10 ways how Paytm earns money-

Paytm Wallet

Paytm Wallet is one of the primary services offered by Paytm. Paytm gained popularity because of its Wallet system. Later, Paytm introduced Paytm Bank Account.

If you transfer your money from Paytm Wallet to the bank account then Paytm charge an interest rate of 4%. If you transfer money from a Paytm wallet to another wallet then no interest will be charged.

You can pay your bills, recharge mobile phones. or book tickets without a penny of interest charged on it. So, Recharging and Bookings is an ideal way to utilize your Paytm Wallet Money.

International transactions can also be done using Paytm Wallet without any fee charged.

Paytm Bank Services

Paytm bank account is a digital bank in which you can make instant transactions to transfer money. Paytm Bank account avail all the services of banks. Paytm bank account become profitable in 2019.

Paytm invests the money received from the banks accounts to Government bond and security. This is how paytm earns money using Paytm bank Account.

Also, Paytm Bank charge interest from borrowers and pay interest to the account holders who have accounts with them. Similar to the conventional banking system but digitally.

Paytm Bank Saving account offers 2.5% interest and 5.5% interest (6% for senior citizens) on Fixed Deposit.

The best part is that no fee will be charged if you break the Fixed Deposit in between. Other banks usually charge 1% fee to break the Fixed Deposit.

You can’t transfer that amount to other banks, you have to utilize that amount in recharges, Paying bills, booking tickets, or paying 3rd party bills like Zomato bills etc. Fixed Deposit of Paytm is a great initiative having great features.

Recharge and Bookings

Paytm charges commission from the service providers of bills, bookings and mobile recharge companies. Although this commission is very small but at a macro level, it is the major source of income for Paytm. No commission is charged from the payer of the bill or recharge.

Not only this, Paytm send you reminders regarding your recharges. By that, you can recharge again with just 2 clicks without filling in the whole information of the recharge and bills everytime. Even you can do an automatic payment system as well.

Paytm enjoys a high commission on ticketed events like Movie tickets. So it offers great cashbacks on Movie tickets through Coupons and refer and earn schemes. You can check out the offers.

Paytm Postpaid Services

Paytm Postpaid service has been launched in partnership with Aditya Birla Finance Ltd with the tagline- “paytm Now, pay later”.

No late fees will be charged for loan amount ranging from 25-100 rupees. You can take upto 60,000 rupees credit. No late fees will be charged in postpaid services till 30 days.

After 30 days, 8-10% interest will be charged per month (maximum- 500 rupees late fees per month). Paytm observed that people usually delay in paying the loan, this will benefit Paytm in earning high returns in form of interest.

For example- If you borrow 5000 rupees and unable to pay within 30 days then you have to pay 120% interest as late fee every year (5000+6,000= 11,000 rupees after 13 months).

Paytm Mall

Many people do not know but Paytm mall has the potential of becoming the best 2nd hand (used product) e-commerce platform in India due to its accessibility to small vendors. Ecommerce is the most highly profitable business. Amazon is one of the examples.

If Paytm play its cards right then Paytm mall will become the best used products marketplace in India. Right now, they are only selling electronic gadgets in the used products category.

Although Paytm is not gaining much popularity in many years, still if they focus specifically on selling best used products then it will be a huge value addition for people with low-income groups.

Insurance

Paytm is now like a Super Market of Insurance because it is offering every possible type of Insurance. Paytm partnered with a government body LIC to offer insurance services.

You can get instant insurance on Bikes and Cars. Paytm also focuses on trending insurances like Dengue Insurance, Corona Insurance, Cyber Fraud Insurance and hospital cash insurance.

Digital Gold

When the whole market is falling, the price of luxuries always rises. Therefore, Gold is considered the safest investment in India.

Paytm introduced digital gold in India due to its high demand in India. Paytm has partnered with gold refiner MMTC-PAMP so here also paytm earn money as commission.

There is no risk of theft with the introduction of digital gold. This gold can be redeemed later whenever the buyer needs it.

Digital gold is the problem-solving product for most households in India. You can buy or sell gold anytime and instantly. You can also buy gold with the smallest amount possible even for 10 rupees.

Paytm Money

Paytm also entered the wealth management industry which involves investment in Stocks, IPO and Mutual Funds. It is India’s first voice based trading feature.

You can directly invest in Stocks, IPO and mutual funds with zero commission and brokerage.

Paytm Seller

As Paytm is a cloud service so it allow brands to advertise their products using Coupons, vouchers, advertisements and app promotions on Paytm Platform.

Paytm offers cashback points and coupons on every transaction by which you can redeem special discounts on big brands. These brands pay Paytm heavy amount for promotions.

Paytm First Games

This fantastic feature is introduced when fantasy and rummy applications are booming the market. Dream 11 is spending millions of money on advertisement and indirectly it profited to Paytm First games as well.

The smart marketing strategy of introducing coupons helped Paytm grow their fantasy and rummy gaming community.

The main business fundamental of Paytm is to partner with specific companies which are provide services that are trending or traditional in India. For example- For LIC, Paytm partnered with LIC. For loan, Paytm partnered with Aditya Birla.

5 Reasons Why Paytm is Successful?

Paytm is the Fastest Payment Service

Paytm just take 15 seconds on average to make the transaction. It is as fast as picking out money from your pocket.

Instead of standing in long queues, now can just recharge your bills and recharges automatically or just in 2 clicks.

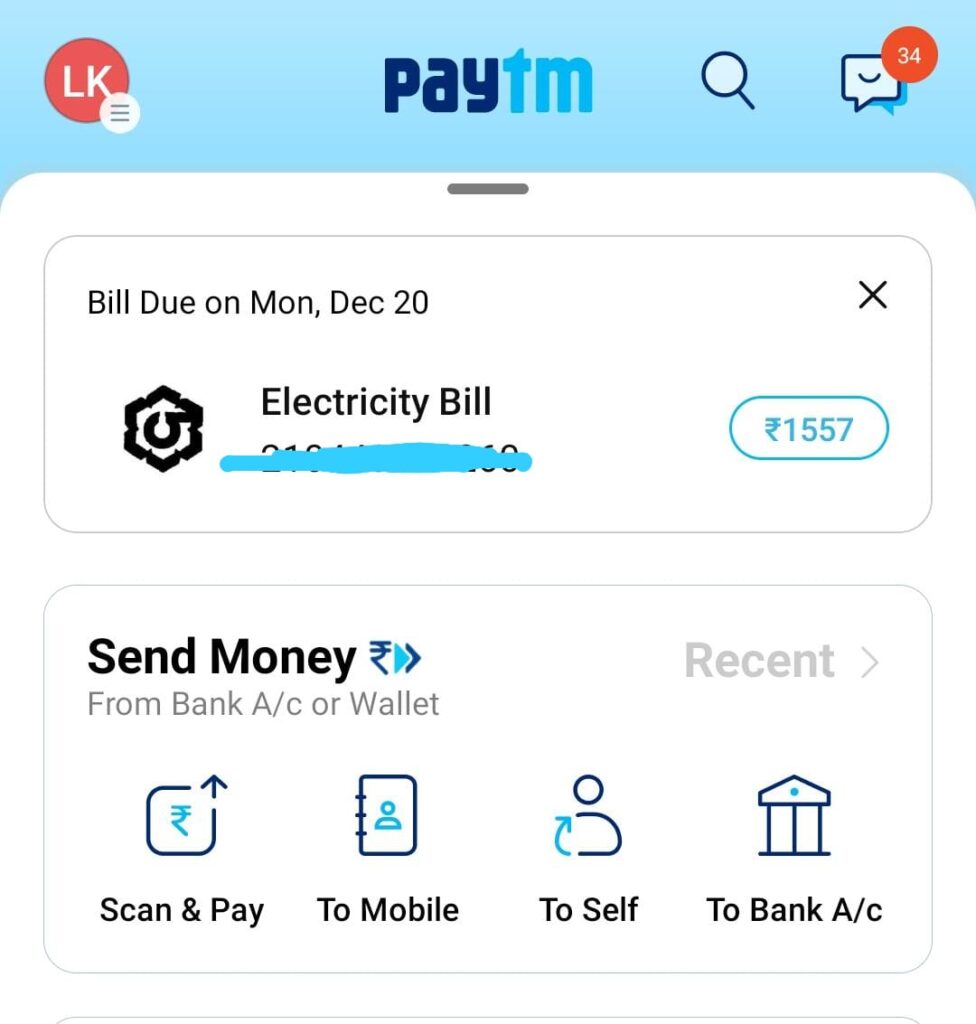

Paytm has a User-Friendly Interface

Paytm’s interface is very user-friendly and easy to understand. Every category is well organized and according to the priority of the users.

For example- Money transfer is at the top then recharge and bookings. These are the most used categories on Paytm so they ranked at the top.

Gives Personalized Feeling

Paytm is available in bilingual languages so that it can be used by locals easily. You can observe that most small vendors in India are using Paytm which is a very proud feeling.

From all the above points we can conclude that Paytm is a very easy-to-use application that is made according to the Indian Audience preference. You can do everything in just a few clicks.

Promotes earning from Referral marketing

Referral marketing strategy helps Paytm to network very quickly among people demographically.

People can earn 100 rupees cashback if someone downloads Paytm from their link. You can download Paytm from this link to make your own referral marketing link.

Paytm is a fast mover

Paytm never delays in executing things quickly. Paytm is expanding its services in almost every field like Insurance, Loans and Wealth Management etc.

One of the prominent examples is when some people start using fake Paytm which causes shopkeepers a very heavy loss.

As a solution, Paytm introduced its speaker(200 rupees only) on Paytm Mall which not only solve the problem but also helped in the advertisement of the E-Commerce feature on Paytm.

Is Paytm making Profit?

Even being so successful, Paytm is still a loss-making company. Paytm’s competition ruins the game of profitability for Paytm. The direct alternatives of Paytm are companies like Google Pay, Amazon Pay, PhonePe, RazorPay and many more.

If you want to see a detailed comparison between Paytm and Google Pay then read this blog- Google Pay Vs Paytm Which Is Better with Full Comparison